How to Keep Track of Your Crypto for Tax Time

Table of Contents:

- Introduction

- Why Tracking Crypto Is Crucial for Taxes

- Understanding Taxable Crypto Events

- Types of Crypto Transactions and Their Tax Implications

- Tools and Software to Track Crypto

- Manual Tracking: A Step-by-Step Guide

- Tips for Staying Organized Throughout the Year

- How to Prepare for Filing Your Crypto Taxes

- Common Mistakes to Avoid

- Tax Professionals vs. DIY Filing

- International Considerations

- Future of Crypto Tax Regulation

- Final Thoughts

- FAQs

1. Introduction

Cryptocurrency continues to reshape the financial world, attracting both retail and institutional investors. However, when tax season arrives, crypto can turn from a financial opportunity into a tax nightmare—especially if you’ve not kept proper records. Whether you’re trading Bitcoin, staking Ethereum, or flipping NFTs, tax obligations follow.

This guide is your roadmap to keeping your crypto organized and tax-compliant. By the end, you’ll know how to keep track of your transactions, minimize your tax liability, and stay on the IRS (or your local tax authority’s) good side.

2. Why Tracking Crypto Is Crucial for Taxes

Unlike traditional finance, crypto doesn’t come with an annual statement from a centralized broker. It’s your responsibility to log every taxable event. If you don’t keep good records:

- You could overpay taxes.

- You might miss out on deductions or losses.

- You could underreport and face penalties.

Tracking isn’t just smart; it’s legally necessary in most jurisdictions.

3. Understanding Taxable Crypto Events

Here are the most common taxable events in crypto:

- Selling crypto for fiat (e.g., BTC to USD) – taxed as capital gains.

- Trading one crypto for another (e.g., ETH to SOL) – taxed as a sale.

- Using crypto to buy goods/services – a disposal event.

- Mining/staking rewards – typically taxed as income.

- Airdrops and forks – often counted as income on receipt.

Non-taxable events:

- Buying and holding crypto.

- Transferring between your own wallets.

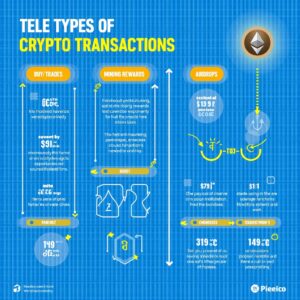

4. Types of Crypto Transactions and Their Tax Implications

| Transaction Type | Taxable? | Tax Type |

|---|---|---|

| Buying BTC with USD | No | N/A |

| Trading BTC for ETH | Yes | Capital Gains |

| Earning interest via staking | Yes | Ordinary Income |

| Sending crypto to your cold wallet | No | N/A |

| Using crypto to pay for coffee | Yes | Capital Gains |

| Receiving an airdrop | Yes | Ordinary Income |

| NFT sales | Yes | Income & Capital Gains |

| Crypto received for work | Yes | Self-Employment Tax |

Understanding how each event is taxed allows you to keep records that are meaningful come tax time.

5. Tools and Software to Track Crypto

Using crypto tax software simplifies the process dramatically. Popular tools include:

1. Koinly

- Supports over 6,000 cryptocurrencies and exchanges.

- Auto-imports transactions.

- Generates tax forms.

2. CoinTracker

- Great for portfolio tracking and taxes.

- Integrates with major wallets.

3. CoinLedger

- Designed specifically for U.S. taxpayers.

- Handles DeFi and NFTs well.

4. Accointing

- Easy interface for beginners.

- Good for EU users.

Pro Tip: Always manually verify imported data—automated tools are not perfect.

6. Manual Tracking: A Step-by-Step Guide

If you prefer doing things manually or want to understand the process, follow these steps:

Step 1: Create a Transaction Log

Use a spreadsheet to record:

- Date

- Type (buy/sell/trade)

- Amount of crypto

- Fiat equivalent at the time

- Fees

- Wallet/exchange used

Step 2: Note the Source

Whether it’s Coinbase, MetaMask, or Binance, keep detailed records of where each transaction occurred.

Step 3: Record Cost Basis

The cost basis is what you paid for the asset. For trades, note the USD value at the time of acquisition.

Step 4: Track Holding Periods

Short-term gains (held < 1 year) are taxed higher than long-term ones.

7. Tips for Staying Organized Throughout the Year

- Use a dedicated crypto email for all exchanges and wallets.

- Label your transactions when they happen (e.g., “NFT sale,” “staking reward”).

- Download monthly statements from exchanges.

- Backup your data—especially from wallets or decentralized platforms.

8. How to Prepare for Filing Your Crypto Taxes

Step 1: Consolidate Your Data

Gather all data from:

- Centralized exchanges

- Decentralized exchanges

- Wallets

- NFT platforms

Step 2: Calculate Gains and Losses

Most tax software does this for you. If not, calculate:

- Gain = Proceeds – Cost Basis

Step 3: Report Your Income

Declare income from:

- Staking

- Mining

- Airdrops

- Payments received in crypto

Step 4: Fill Out Tax Forms

For U.S. users:

- Form 8949: Capital gains and losses.

- Schedule D: Summary of Form 8949.

- Schedule 1 or C: For income from staking or self-employment.

9. Common Mistakes to Avoid

- Ignoring small transactions: Even $5 gains count.

- Double-counting transactions across wallets.

- Failing to report lost or hacked coins (these may qualify as deductions).

- Missing DeFi or NFT transactions which many tools don’t catch automatically.

10. Tax Professionals vs. DIY Filing

DIY Filing Pros:

- Cost-effective

- Educational

- Good for simple portfolios

When to Hire a Tax Pro:

- Complex DeFi/NFT transactions

- High transaction volumes

- Business-related crypto use

- International crypto exposure

Choose a CPA or EA experienced in cryptocurrency.

11. International Considerations

Different countries treat crypto differently:

- U.S.: Capital gains and income taxes.

- UK: Treated as property; CGT applies.

- Germany: Tax-free if held for over a year.

- Canada: Similar to U.S., but stricter.

- Australia: CGT and income tax depending on use.

Always check with your local authority for guidance.

12. Future of Crypto Tax Regulation

Governments are tightening rules:

- U.S. Infrastructure Bill mandates more broker reporting.

- EU’s MiCA framework includes stricter KYC and AML.

- Expect real-time tax reporting, especially for centralized platforms.

Being proactive now helps you avoid trouble later.

13. Final Thoughts

Crypto taxes can be complicated, but they don’t have to be chaotic. Staying organized, using the right tools, and understanding your responsibilities are the keys to avoiding audits and minimizing your tax bill.

Track everything. Review often. File accurately.

And most importantly—start today.

14. Frequently Asked Questions (FAQs)

Q1: Is every crypto transaction taxable?

Not all. Buying and holding is not taxable. Selling, trading, or earning crypto is.

Q2: What if I lost access to a wallet?

You may be able to write off the loss, but documentation is required. A tax pro can help.

Q3: Can I use crypto losses to offset gains?

Yes, capital losses can offset gains, and up to $3,000 can reduce ordinary income in the U.S.

Q4: Do I need to report crypto if I didn’t sell?

No tax is due for simply holding. But U.S. taxpayers must still check “yes” on the 1040 if they held or transacted.

Q5: How far back do I need to keep records?

Generally, 3–7 years depending on your jurisdiction, but best to keep everything permanently in digital form.

Q6: Can I pay taxes in crypto?

Some jurisdictions (like certain U.S. states) allow it. Check locally.

Q7: What if I use multiple exchanges and wallets?

You must aggregate all data into a single tax report. Most tax software supports this.

Q8: How are NFTs taxed?

Selling NFTs is a taxable event. If you created and sold them, it’s income. Buying and flipping is subject to capital gains.